Everything from the rewards program structure to the annual fee, interest rate and other account features on your next credit card can affect your experience as an account holder. Chase is among the most well-known national banks, and it offers several credit card options for you to compare and choose from. The features and applicant requirements for Chase’s best credit cards vary dramatically. However, you may notice that the bank has relatively uniform requirements and options for billing, administrative services, and customer service solutions. Further review of the account options and features may help you to identify the right credit card to apply for.

Table of Contents

- Best Chase Credit Cards

- Who qualifies for a Chase Visa Card?

- Pre-approved offers by mail

- Chase credit card benefits & rewards programs

- Chase credit card application process

- Checking on your credit card application status

- How to activate your Chase credit card

- How to login to your Chase credit card account

- How to request a credit card limit increase

- What is the grace period for a Chase card?

- Getting a cash advance with your Chase Visa Card

- Credit card statement options

- Making your credit card payment online

- Paying your Chase credit card bill by mail

- Can you pay your Chase credit card at Chase Bank?

- Adding and removing authorized users

- Credit card fraud protection

- Disputing unauthorized charges

- Reporting a lost or stolen credit card

- Travel insurance

- Credit card arbitration clause

- Chase credit card customer service

Best Chase Credit Cards of 2020

- Top card for balance transfers: Chase Slate®

- Top card for travel: Chase Sapphire Preferred®

- Top card for cash back rewards: Chase Freedom Unlimited®

- Top card for families: Disney® Visa® Card

- Top airline card: Southwest Rapid Rewards® Plus

Chase Slate® credit card

- Offer for New Card Members: Transfer balances with an introductory fee of $0 during the first 60 days your account is open. After that, the fee for future balance transfers is 5% of the amount transferred, with a minimum of $5.

- Notable Features: 60 day introductory balance transfer offer, save on interest, and get your free credit score updated weekly with Credit Journey.

- APR: 0% intro APR for 15 months on purchases and balance transfers from account opening. After that, 14.99%–23.74% variable APR.

- Annual Fee: $0

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: Chase Slate Application & Information

Chase Sapphire Preferred® credit card

- Offer for New Card Members: 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 toward travel when redeemed through Chase Ultimate Rewards®.

- Notable Features: Earn 2X points on travel and dining at restaurants.

- APR: 15.99%–22.99% variable APR.

- Annual Fee: $95

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: Chase Sapphire Preferred Application & Information: Rewards Program Agreement

The big brother to the Chase Sapphire Preferred is the Chase Sapphire Reserve. This card has a higher annual fee than the Preferred Card and a slightly smaller sign-up bonus of 50,000 points when you spend $4,000 in the first 3 months. However, it comes with 3x points on dining and on travel and a lot more travel perks than the Preferred has to offer. One downside is that you don’t earn 3x points on travel until you earn your $300 annual travel credit at the end of your first year. The APR is 16.99% – 23.99% variable with an annual fee of $550.

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: Chase Sapphire Reserve Application & Information: Rewards Program Agreement

Chase Freedom Unlimited® credit card

- Offer for New Card Members: Earn $200 cash back after you spend $500 on purchases in your first 3 months – Offer is available to those who apply to the site directly

- Notable Features: Cash back on every purchase. Earn 1.5% cash back on all purchases.

- APR: 0% intro APR for 15 months from account opening on purchases and balance transfers. After that, 14.99%–23.74% variable APR.

- Annual Fee: $0

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: Chase Freedom Unlimited Application & Information: Rewards Program Agreement

Disney® Visa® Card

- Offer for New Card Members: $50 Statement Credit after first purchase with a new Disney Visa Card.

- Notable Features: Earn 1% in Disney Rewards Dollars on all card purchases. Redeem toward most anything Disney at most Disney locations. Enjoy special vacation financing and shopping savings. Terms apply.

- APR: 15.99% variable APR. 0% promotional APR for 6 months on select Disney vacation packages from the date of purchase, after that a variable APR of 15.99%.

- Annual Fee: $0

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: Disney Visa Card Application & Information: Rewards Program Agreement

Southwest Rapid Rewards® Plus Credit Card

- Offer for New Card Members: Earn 40,000 points after you spend $1,000 on purchases in the first 3 months your account is open.

- Earn reward flights with no blackout dates. Receive 3,000 bonus points on your card anniversary. Plus earn 2X points on Southwest® purchases and 1X points on all other purchases.

- APR: 15.99%–22.99% variable APR.

- Annual Fee: $69 applied to your first billing statement.

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: Southwest Rapid Rewards Plus Card Application & Information: Rewards Program Agreement

UnitedSM Explorer Card

- Offer for New Card Members: Earn 60,000 Bonus Miles after you spend $3,000 on purchases in the first 3 months from account opening.

- Notable Features: Benefits include 2 miles per $1 spent on United purchases, at restaurants, and on hotel stays. Plus, enjoy free first checked bag and other great United travel benefits. Terms apply.

- APR: 16.49%–23.49% variable APR.

- Annual Fee: $0 intro annual fee for the first year, after that $95.

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: United Explorer Card Application & Information: Rewards Program Agreement

British Airways Visa Signature® card

- Offer for New Card Members: Earn up to 100,000 Avios. Earn 50,000 Avios after you spend $3,000 on purchases in your first 3 months. Plus, earn an additional 50,000 Avios after spending $20,000 total on purchases in your first year of account opening.

- Notable Features: Earn 3 Avios per $1 spent on purchases with British Airways, Aer Lingus and Iberia, 2 Avios on hotel stays booked directly with the hotel, and 1 Avios for every other $1 spent.

- APR: 15.99%-22.99% variable APR.

- Annual Fee: $95

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: British Airways Application & Information: Rewards Program Agreement

Marriott Bonvoy Bold™ credit card

- Offer for New Card Members: 30,000 Bonus points after you spend $1,000 on purchases in your first 3 months from your account opening with your Marriott Bonvoy Bold™ credit card.

- Notable Features: Earn Unlimited Marriott Bonvoy™points and get free stays faster. Earn points on every purchase and 3X points at over 7,000 Marriott Bonvoy™ participating hotels.

- APR: 15.99%–22.99% variable APR.

- Annual Fee: $0

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: Marriott Bonvoy Bold Card Application & Information: Rewards Program Agreement

The World of Hyatt Credit Card

- Offer for New Card Members: Earn up to 50,000 Bonus Points. Earn 25,000 Bonus Points after you spend $3,000 on purchases within the first 3 months of account opening. Plus, an additional 25,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months of account opening.

- Notable Features: Turn every purchase into more free nights. Earn Bonus Points on every purchase, 4 Bonus Points per $1 spent at Hyatt hotels. Plus, 1 free night every year.

- APR: 15.99%–22.99% variable APR.

- Annual Fee: $95

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: The World of Hyatt Credit Card Application & Information: Rewards Program Agreement

Ink Business PreferredSM credit card

- 100,000 bonus points after you spend $15,000 on purchases in the first 3 months after account opening. That’s $1,250 toward travel rewards when you redeem through Chase Ultimate Rewards®.

- Notable Features: Reward your business with premium travel rewards. Earn 3X points on travel and other select business categories.

- APR: 15.99%–20.99% variable APR.

- Annual Fee: $95

Note: While we do make every attempt to update, please visit Pricing & Terms for the most current details.

More Information: Ink Business Preferred Card Application & Information: Rewards Program Agreement

Who qualifies for a Chase Visa Card?

Specific applicant requirements for each Chase credit card option vary slightly. Generally, Chase requires approved applicants to have a good credit rating, which means that the credit score is 700 or higher. In addition, applicants typically must have at least three years of established history as well as reliable income. Notably, Chase strictly follows a 5/24 rule. Under this rule, if the applicant has five or more new accounts opened within the last 24 months, the application will be denied. This holds true regardless of the applicant’s credit rating. Keep in mind, however, that some of Chase’s credit cards are not included in the 5/24 rule. For example, many of its hotel brand-specific rewards program accounts will not impact the 5/24 analysis.

Chase also reviews your credit utilization rate for account qualification purposes. While you generally should apply with a 30 percent credit utilization rate or lower, the specific requirement varies by credit card and may be overlooked with other compensating strengths. Applicants must also have a physical address, and U.S. citizens will need to provide their Social Security number.

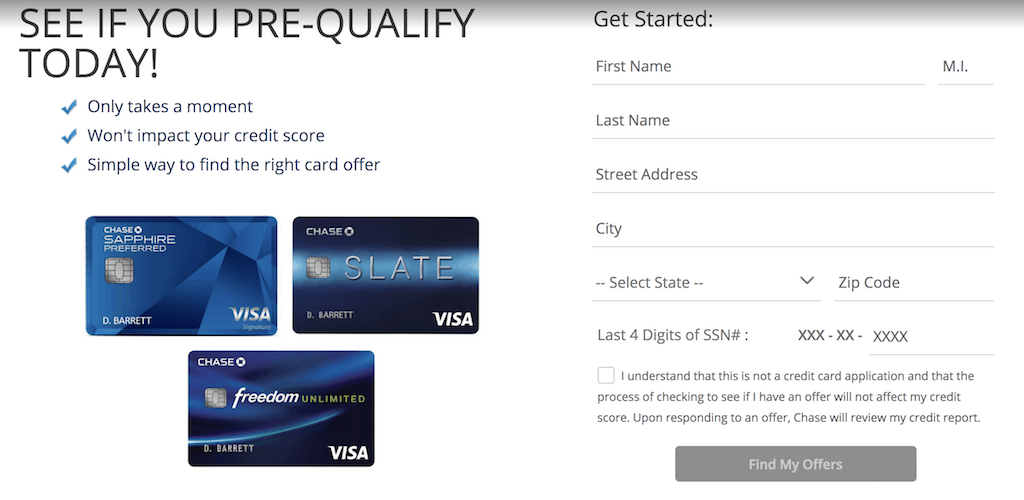

Pre-approved offers by mail

Chase provides pre-approved credit card offers to qualified individuals. The qualification is based on a soft credit pull, which means that Chase has reviewed your credit score in a manner that does not impact your credit rating. If you choose to take advantage of a pre-approved offer, Chase will complete its credit analysis with a hard pull to confirm that you meet all of its credit analysis requirements.

If you did not receive a pre-approval offer by mail, you may still learn about your eligibility through the bank’s website. You simply provide your name, address and the last four digits of your Social Security number. Chase will complete a soft credit pull, and the website will quickly generate a list of credit card programs that you may qualify for. This is a quick, convenient way to narrow down the account options for review and analysis before applying.

Chase credit card benefits & rewards programs

Each Chase rewards program has a unique structure, so you should carefully compare the rules and limitations before applying. Generally, you can earn points for spending in areas like food and restaurants, travel and more. Many Chase credit cards have an introductory rewards bonus. For example, the Chase Sapphire Preferred card provides you with 60,000 points if you spend $4,000 within the first three months. Other cards include travel benefits, for example, the Chase Sapphire Reserve offers an application fee credit up to $100 for Global Entry or TSA PreCheck and free Priority Pass Select membership.

In many cases, the rewards points can be redeemed for a wide range of items, including an account credit, cash back, gift cards and products. With other types of Chase credit cards, the points can only be redeemed for specialized items. For example, points on the Disney Rewards credit card can be redeemed for dining, shopping, resort stays and theme park tickets for Disney and Star Wars venues. Some Chase credit cards also come with discounts and other special rewards. For example, the Disney Rewards credit card provides discounts through the Disney Store as well as on guided tours, branded merchandise and more.

Redeeming points is a fairly simple process. You can redeem online through the Chase Ultimate Rewards site, call the number on the back of your card, or go to a Chase branch.

The rewards points and cashback benefits for many Chase credit cards have monthly, quarterly or annual caps. Furthermore, the points may need to be redeemed or used within a specified period of time, or they may be lost. However, restrictions do not apply to all Chase rewards credit cards. For example, the Chase Freedom Unlimited account provides you with unlimited cash back on all purchases. Accumulated benefits will never expire. Read the fine print before applying for a rewards credit card to ensure that you understand the program requirements and limitations.

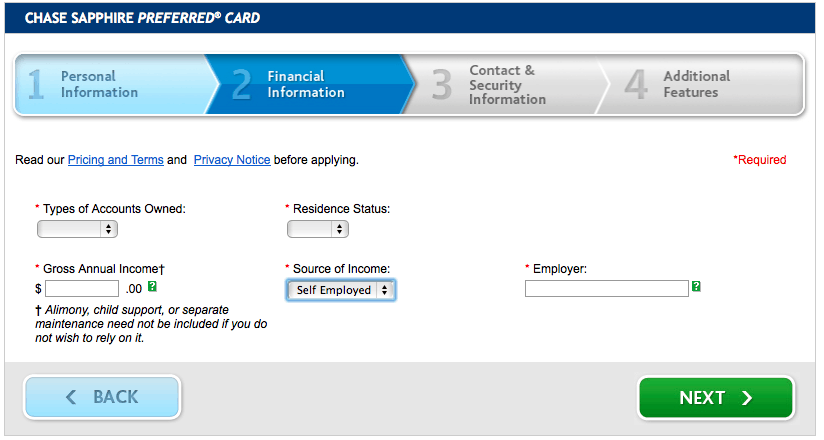

Chase credit card application process

Most applicants apply for a Chase credit card online either through Chases’ Website and or mobile app. If you are new to the app, you will need to accept the mobile terms. You can apply as a guest without a pre-existing Chase account. Or, if you are an existing Chase customer, you can conveniently sign in to your account as usual to save time. By logging in, some of the application fields will be automatically populated from the information that the bank has on file for you. Another option is to apply through your local branch. By doing so, a live bank representative may complete a soft credit pull review initially. Through this step, you may learn about credit card offers that you may be pre-approved for. This step can also be done online without the need to venture into your local Chase branch. A final option is to apply over the phone by calling Chase’s toll-free customer service number.

Regardless of your preferred application method, you will need to apply for a specific type of credit card. For example, you would apply for the Chase Sapphire Preferred card rather than submit a generic application that encompasses all credit card options available. After determining which type of account you wish to apply for, you can easily complete the application within a few minutes. The application requires you to provide your name, address, income and employment information, Social Security number, and a few other critical pieces of personal information. As you are going through the process please review its terms to ensure you understand the application and the card contract. If you have any questions ask the representative if you are there in person or call to speak with someone to clarify the terms before sending in the application.

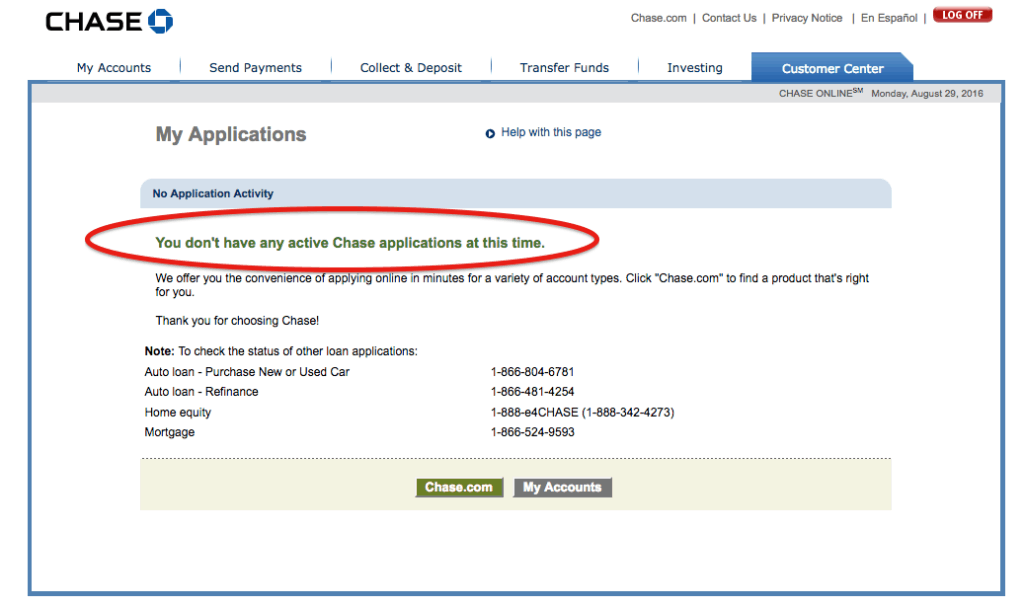

Checking on your credit card application status

Many years ago, credit card applicants were required to mail a completed application form to the bank for manual review and approval. In some cases, several weeks may have passed between the time the application was dropped in the mailbox and the time when an approved applicant received his or her credit card in the mail. Modern technology has dramatically improved the speed of the application process. In many cases, applicants who submit an application online, by phone or in person at a branch location will receive a firm response within a few minutes or less. If the application is approved, the credit card will be mailed to the address on file within a few days. Because the application is reviewed and potentially approved quickly, there is usually no need to sign into your account and check on the application status. If you do need to check on the application status, you can do so online only if you have created an account. Otherwise, you can check on your application status by calling the toll-free number for customer service.

If the credit request is denied, the applicant may receive written notification by mail stating the reason for the denial. In rare instances, the bank will notify the applicant in writing that additional information or documentation is needed before the application can be approved.

How to activate your Chase credit card

You will not be able to use your new Chase credit card until it has been activated. If you have not already done so, you should create an online account. With an online profile, you can review your account balance, make payments, connect with other Chase financial accounts and complete other activities. Once your online profile has been created, simply use the “Verify Credit Card” page to activate your Chase credit card. This can be done within a few minutes or less. Another option is to call the toll-free number listed on the sticker on your new credit card. Follow the automated instructions to finish the activation process. As a final step, sign the back of your card before you use it for the first time.

How to login to your Chase credit card account

You can login to your Chase credit account online through Chase’s home page. You may also download the mobile app to sign in via your smartphone or another connected device. You simply input the login ID and password that you used to establish the account. If you have forgotten either one, you can follow the reset steps through the website or the app. You may also contact Chase’s toll-free customer service phone number for additional assistance.

The initial screen that you see after logging in will show basic details about each of your Chase accounts. Click on the link for your Chase credit card to view detailed account information. This may include your account balance, available credit, next payment due date, the minimum payment amount and other details. Through the app, you can make an immediate payment or schedule a payment for a future date.

How to request a credit card limit increase

Chase periodically reviews credit accounts to determine eligibility for a credit limit increase. If you qualify, you may receive a notice via email or through the postal service that outlines the details of the credit limit increase. You may also request a credit limit increase on your own at any time. The most convenient method available for account holders who have an online profile is to simply sign to their account through the “Line Increase” page. The decision is usually based on a hard pull of your credit report, your account payment history, and other factors. In most cases, the amount of an approved increase is determined through an automated review within minutes. The alternative to requesting a credit limit increase is to contact the Chase customer service phone number. The process and timing for a telephone request is typically similar to an online request.

What is the grace period for a Chase card?

The typical grace period for a Chase credit card is 21 days. During the grace period, your account may not accrue interest as long as the payment is made in full. However, if you do not pay the balance in full within the grace period one month, you will lose the grace period. The grace period can be reinstated by paying the full balance for two consecutive months. Any outstanding balance that carries over after the grace period will be subject to interest accrual. You may still be assessed a late payment fee as soon as the first day that the minimum payment is late.

Be aware that the Chase credit card grace period pertains to credit card purchases only. It does not cover balance transfers or cash advances. Interest accrues on these balances on the first day or after a special zero-interest offer expires.

Getting a cash advance with your Chase Visa Card

With a cash advance against your Chase credit card, you can draw hard cash out of your account and use it for any desired purpose. The cash advance interest rate may be higher than the standard interest rate on regular purchases. In addition, you may be charged a processing fee for the cash advance. Depending on your account’s terms, this may be a flat fee or a percentage of the amount of the advance. Keep in mind that the amount available through a cash advance is typically lower than your credit limit.

You can pull cash out of your Chase credit card through any Chase ATM without paying an ATM transaction fee. You may use an ATM for another financial institution, but your transaction may be subject to additional fees. To draw cash from your credit card via an ATM, you will need to input your PIN. If you have not established a PIN or have forgotten your PIN, visit your local Chase branch for personal assistance.

In some cases, you may receive convenience checks in the mail. These enable you to write a check that draws from your Chase account in the form of a cash advance. These checks may be used to make direct payments to service providers, retailers or others. You can also write a check to yourself to make a deposit in your personal bank account. When using these checks, you may be assessed a special transaction fee.

Review your account terms before taking a cash advance against your Chase credit card account. In addition to not being eligible for the grace period, the cash advance balance may be subject to a special and potentially higher interest rate until the balance is paid in full. Furthermore, your monthly payments may be applied to standard purchases first unless you specifically request otherwise.

Credit card statement options

The default setting for Chase credit card statements continues to be a paper statement mailed at the end of each billing cycle. However, you can opt out of the paper statement. With the paperless option, account holders receive an email notification with statement details. The current billing statement and previous statements are available to download, view, and print as desired. In some instances, account holders may receive a financial incentive, additional rewards points or other benefits upon setting up paperless statements.

Making your credit card payment online

The minimum payment amount and due date are visible on each account statement. This information is also available through the app and on the Chase website when you sign in to your account as well as through the customer service phone number. Many account holders prefer to make their payment online, which may be done through the website or the Chase app. You can specify the payment amount and the transaction date. Payments can be scheduled in advance as a convenience, or you can schedule a recurring automated payment. It is important to make your payments securely online and to log out of your accounts before leaving the computer for security reasons. Look for ‘leaving Chase’ or the words ‘logged out’ before you leave. Other possible payment alternatives include mailing a check and making a payment over the phone.

Paying your Chase credit card bill by mail

If making online payments aren’t for you, you can always pay by mail.

Mail your check or money order with your name and account number to:

Cardmember Services

P.O. Box 6294

Carol Stream, IL 60197-6294

Can you pay your Chase credit card at Chase Bank?

Another credit card payment option is to make an in-person payment at any Chase Bank branch location throughout the country. Payments can be made using a check, cash or an account transfer from your Chase checking or savings account. Your identity will be confirmed via a valid photo ID, and you will need to provide the credit card account number. The payment will be processed on the same business day.

After your Chase credit card is established, you can add authorized users as desired. Typically, authorized users are a spouse or children of a personal credit card’s account holder. For a business account, authorized users are usually employees. Authorized users do not need to pass a background or financial check. While they are not financially liable for the account balance, the account will impact their credit rating. Because of this, a common reason for parents to add older children as authorized users is to help them establish a positive credit history.

The primary account holder can add authorized users making the request online after signing into the specific account. Typically, you need to provide their full legal name, mailing address, and date of birth for each individual you wish to add. There is no approval process, but the information must be accurate in order to keep your Chase credit card account in good standing. The authorized user should receive a copy of his or her credit card within one to two weeks. There is typically no cost to add an authorized user with most Chase credit card accounts, but you should inquire about the possibility of a fee before moving forward.

With Chase personal credit cards, authorized users have unrestricted access to the full credit limit. You may establish limits with select business credit card accounts. Authorized users are not permitted to make changes to the account, and they may not be able to access specific account details that the primary account holder could access.

Authorized users can remove themselves from an account by contacting the customer service phone number. The primary account holder may also remove authorized users in this way. The individual will no longer have account privileges. When an authorized user has been removed, the account will show as terminated on his or her credit report only. All payment and account history up to the termination date will continue to be reflected on the individual’s credit report in the same manner that any other credit card account would.

Credit card fraud protection

Credit card fraud includes card skimming, phishing scams, identity theft, and other issues. If you identify any signs of fraud on your Chase credit card, you should contact the Chase customer service department as soon as possible. You do not need to know how the fraudulent activity occurred because Chase will typically investigate the activity on your behalf. In some cases, Chase will detect possible fraudulent activity and may place a hold on your account until you confirm the charges. Additional fraud protection includes the use of chipped cards and the ability for users to set notifications for all account activity.

You are not required to pay for unauthorized charges to your account, but you should notify Chase as soon as possible to begin the dispute process and to prevent additional unauthorized charges. After reporting fraudulent activity, your account will be frozen. A new credit card will be mailed to you, and you will not be able to access or use your account until you have activated the new card.

Disputing unauthorized charges

The primary account holder and authorized users may dispute charges on a Chase credit card. The dispute can be initiated online or by mailing the bank a written request. Your account may be temporarily credited while the dispute is investigated. The investigation typically takes between one to two months. If the investigation reveals that the disputed charge is valid, the charge will be reapplied to your account. All accrued interest will also be applied.

Reporting a lost or stolen credit card

As soon as you discover that your Chase credit card has been lost or stolen, you should immediately notify the bank. The most convenient and common reporting method is via a phone call to the customer service department. The phone representative will review the last few charges made to the account to ensure that all charges are authorized. The account will then be frozen, and a new card will be issued. Once the new card has been activated, the account holder will have full access to the account again.

Travel insurance

Some Chase credit card accounts include travel insurance, which would be effective if the trip was paid for with the account or with rewards benefits. The coverage provides cash reimbursement for trip interruptions for the account holder and immediate family members who are on the trip. The specific benefits of travel insurance vary by card, but some acceptable reasons for a claim may include illness, death of an immediate family member, severe weather, a court subpoena and more. Common expenses that may be refunded include cruise and airline fares, tour expenses and hotel fees that are not directly refundable by the company or provider. The account holder should file the claim as soon as possible and may need to provide written documentation supporting the reason for the claim.

Credit card arbitration clause

All Chase credit card users are obligated by an arbitration clause unless they specifically opt out in writing. Under this clause, the account holder gives up the right to take a dispute with Chase to court and states that the matter must be resolved by binding arbitration. The exception is if the matter could be resolved in small claims court. This clause also prevents account holders from participating in class action lawsuits against Chase. All account holders can opt out of this specific clause in their contract by mailing a request to the bank. Confirm receipt of the letter to ensure that your account has been properly updated.

Chase credit card customer service

Personal Credit Cards

Customer Service: 1-800-432-3117

International: 1-302-594-8200

Business Credit Cards

Customer Service: 1-888-269-8690

International: 1-480-350-7099

General correspondence by mail

(by U.S. Postal Service, including Certified Mail)

Card Services

P.O. Box 15298

Wilmington, DE 19850

Servicemembers

You can submit your request for Servicemembers Civil Relief Act (SCRA) benefits by:

Email through the secure message center at Chase.com

OR

Phone: Chase Military Services at (877) 469-0110

OR

Mail:

SCRA Request

P.O. Box 183240

Columbus, OH 43218-3240