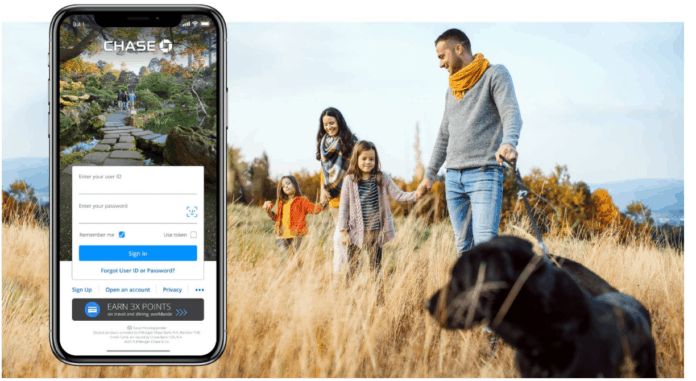

When you bank with Chase, you will likely want to use their mobile banking app. This app allows you to deposit checks, check your credit score, check your account balance, link to any Chase credit cards you have, and even transfer money. Continue reading to learn how you can make the most of the Chase app to get the customer service you deserve.

What is the Chase Mobile app?

The Chase mobile app allows customers to mange a variety of banking accounts and services provided by JPMorgan Chase Bank NA. When you sign into the app, you will sign in with the same user information that you created when you started using the Chase website. If you have just started with Chase, you can set up your online banking account online or on the app. When you are in the banking app, you get access to all the Chase accounts you have opened no matter how expansive they may be.

How the Chase Mobile app works

You can download the Chase app from the Google Play Store or the App Store. The app allows you to see your bank accounts, credit cards, and even your loan accounts. Because everything has been consolidated in one place, it is much easier for you to manage your money. You can even make quick payments to your cards or loans if you like.

If you have business credit cards or rewards cards, you can check the rewards in the app. The app will send you to a special page where you can check on those rewards or redeem them. Every Chase customer can use the app to get the same service they would get on the website or over the phone. This is a major advantage of the app because it does not disallow any function for its customers.

What can I do with the App?

As mentioned above, you can check your balance, manage your credit cards, and review your loans. You can use the Chase quick deposit check feature that allows you to scan your checks, and those checks will be posted to your account quickly. You can use the app to transfer money using Zelle to any other Chase account or accounts outside Chase. You can even set up your account to pay your bills automatically. Chase takes care of everything, and you can change the terms of those payments at any time. This is a simple thing to do, and it helps you avoid any late payments that may have been troublesome in the past.

The app also sends you alerts when you are making payments or waiting for deposits. The app also connects to your phone number so that Chase can send you fraud alerts. When you get a fraud alert, you can be sent into the app to see the fraudulent charges. From there, you can lock the card or account that has been used without your permission, and you can use the app to call Chase directly.

If you are calling for general customer service, you can click on the contact page, and you will be forwarded to a Chase representative who can see your information and help you right away. You do not need to choose the right function when you call, and you can get your questions answered quickly. IF you prefer live chat, you can use the live chat feature to talk to an associate.

How long does mobile deposit take?

The mobile deposit typically takes one business day to complete. When you post your check before the close of business that day, it is typically approved the next day. You can see the check as pending on your account, but the money will not be there yet. If the check is very large, you may need to wait an extra day for verification.

You can deposit as many checks as you want in one day, but you must be aware of the value of each check. In some cases, large checks will not go through as fast as smaller checks. You might believe that it should not take very long for all your checks to go through, but they are not all the same. Also, certain banks may make verification of you check take longer than normal.

Is the Chase app free?

When you use the mobile app from Chase, it is free to download. However, Chase wants you to remember that message and data rates may apply when you use the functions of the app. You must also remember that your business account is found inside the Chase app. You do not need to sign up for another service or download another app. Companies online might lead you to believe that you need to pay for their app to help manage your Chase business account, but they are not offering you the Chase app. Chase is always free to use.

Is the Chase app safe?

Chase uses advanced security technology to ensure the safety of its customers. You can go into the menu to see the security steps that Chase has taken. Chase also recommends that you use the app on a secure wifi connection. This means that you should not use the Chase app on public wifi or on a wifi signal at work that might be monitored. Using your home’s wifi or mobile carrier’s data connection is much more secure.

How do I get the Chase Mobile app?

You can go to the Chase website or your app store to search for the app. You can choose the app, allow it to download to your device, and sign in with your online banking information. If you download through the Chase website, you can choose the platform that you prefer to use.

When the Chase app downloads, it does not take up much space on your phone. You may, however, want to clear the cache on the app every few months to prevent the app from taking up too much space. This will ensure the best performance will giving you the customer service that you need when you need it. You must also ensure that the app is set up to automatically update. Your app store will complete the updates for you so that you get all the latest features that Chase gives to its customers.

The Bottom Line

The Chase app is very easy to use, and it allows you to access all the Chase banking services that you need. The app lets you check your Chase credit cards, loans, and bank balances. You can contact customer service through the app, and you can use the app to ensure that you get fraud alerts about your accounts. You can transfer money if you need to, scan a check for a deposit, or even check your credit score when you keep the Chase app on all your mobile devices.